Saving Sunday: To buy or Not to buy

That is the question… always. “Shall I get it?”

Since I decided to be more “financially responsible” several years ago, when in doubt, I ask these questions.

Do I Must have it?

How Long will it last?

Financially feasible?

Emotionally Satisfying?

Each question has 10 points. 10 is YES – 5 is MAYBE – 1 is NO.

Usually, you don’t ask questions about necessities, like toilet paper. BUT if you started argue with your husband about what type of toilet paper you should buy, this can be used as an assessment tool.

Of course we must buy TP (10), and I like a certain kind of TP because it is so soft (emotionally 8), but my “brand TP” maybe pricey (Financially 3). Question is how long would it last? Oddly, the double rolls last longer than 99 cent store TP. So, I would give it 7. So total point for my TP is 28.

How about 99 cent store TP? Must – 10. Emotionally – 2 (for me). Financially – 10, but if it doesn’t last long (2) – It’s 24.

So the winner would be …. Brand Double Roll TP!

If you are considering buying a single item and not sure…. you can still use this.

I love scarves. I get cold so easily, and I wear them all the time, but I have a LOT of them (Must – 5). I like Hermes, Varsace scarves, (Financially 2 – expensive!) but it lasts long time (8 – never go out of style) and it makes me happy. (10). The total is 25. Since my “BUY NOW” point is 30 points, I would wait till I get some extra funds or special occasion.

Next time you are at a register – make sure to ask yourself “Do I need it?” and “How long… (temporary)” to fight off the temptation.

Think LONG TERM – save for the future and be happy!

Saving Sunday: Got an Antenna

One of many ways to save money is to reduce the fixed expenses. I often call my cellular company (Verizon) to reduce the monthly fee, while keep checking how cheaper carrier (T-mobil) signals are getting strong enough or not.

We don’t watch TV. So it doesn’t make any sense for us to keep a cable.

BUT did you know broadcast stations continue to send out their TV signals – for free? You will need a good antenna, but it worth looking into it.

Saving Sunday – Millennials may learn from babyboomers

https://www.wsj.com/articles/with-15-left-in-the-bank-a-baby-boomer-makes-peace-with-less-1487259894

I created “save a lope” ™ to teach financial literacy to my child. The first thing was show him: We give CASH in exchange of THINGS. Money goes out of the wallet when we purchase things. Very simple.

If we don’t have money, we cannot buy things.

You save for things you need to buy. I want to make sure he would never spend the money he doesn’t have.

We all made that mistakes with credit cards. But it looks like we continue to make that mistakes in spite of the awareness that “debt is bad.”

Because it is a habit. Habit of spending was introduced before habit of saving.

Our generation may not be able to retire ever. But I want our next generation to be able to enjoy life more than us.

Millennials may need to double their saving for retirement. Saving would be easier if you are NOT distracted by buying more stuff to make you happy. Focus on “health” “value” “moral” factors before pulling money out of your wallet.

Happy Saving –

Saving Sunday: Be boring!

“Automation” = “Autonomy”

There are certain things that we have to do and get it done always, like doing laundry, paying bills, eating breakfast.

Instead of waiting till have no clean clothes, have pay late fee or get really hungry that you cannot stop opening the fridge to look what’s in there, put the duties in automation.

My laundry dates are Mondays and Fridays. I stick with schedule regardless of how much dirty clothes we have.

Bill payments are taken care of on between 1st to 5th day or 15th of every months.

My breakfast … I am still working on that one. Ideally, I love to have “Japanese breakfast” – rice, veggies and miso soup everyday. But making rice every morning can be tricky. (Instant rice produces too much plastic waste – so I am trying to avoid that! ) So, I often ended up eating a Larabar at 1 PM because I forget to eat.

Plan ahead and be consistent. You can avoid a lot of “last minute spending”

We use to have more “meat” days, but we cut down on beef last year, as part of our regular meal.

Saving Sunday: Start small

“The secret to savings is knowing you have enough and stopping the voice in your head that thinks adding more will make you happy.”

Imagine, at the end of the year, you will have emergency funds stashed away. You can start small ($20 a week will be $1000 at the end of 2017). To make it more solid, do it for 10 years, and you will have $10k saved for something really important in your life.

You do not need to change anything. Just add simple habits.

After all, what we are striving to be is one thing: Happy. To me, it is my friends, my family, my projects and quiet reading time that brings me happiness.

So since my kid was born, my motto is: Work less, spend less. So I can spend more quality time with them.

And to take one step further, I also love to have the sense of security a little bit. Thus, I started “saving.”

Here are simple “Habits” I created for myself:

- Don’t Do “debt”

- Be a mindful spender

- Save now. Spend later. (“Do I need this?”)

- Avoid cheap stuff. They won’t last.

- PLAN AHEAD.

Of course, I go nuts during the holiday seasons. But I have $500 cash from SaveALope as my part of annual budget. And the rest ($1000) goes to the “annual saving account.”

Saving Sunday: This Holiday Season….

Shoppers around the country say they are planning to spend an average of $929 for gifts this holiday season, up from $882 last year according to the 32d annual survey on holiday spending from the American Research Group, Inc. Planned gift spending for 2016 is $47 above spending in 2015 and it is the first time planned gift spending exceeds $900 since 2006.

https://americanresearchgroup.com/holiday/

$929 per person? That is a lot of money! For family of three adults, that would be almost $3000.

During the holiday seasons, we see so many wasteful gifts.

Here’s my 3 rules of FRUGAL GIFT GIVING.

1) Is it PRACTICAL? No joke gifts, no clothings unless you know the person REALLY well.

2) Is it CONSUMABLE? Give an upgrade version something she or he already has and using that is consumable.

3) Are you sure that is something she or he wants. When in doubt – go for a gift cards or 1) & 2).

My not too exciting but not wasteful gifts includes:

- Soft bath towel sets

- Throw Pillows

- Silk scarves (made by local artists)

- Organic not perfumery soaps

- Socks

Also, my golden rule: DO NOT USE A CREDIT CARD. USE CASH FOR ALL THE GIFTS. (And keep the receipts if it is business related, of course)

Happy Saving

Planning … Sweetly

Every time I go to a market with my son, I will make a promise that he can tell me one thing he wants to get BEFORE we step in to the market. It could be a carrot, jelly beans, eggs – whatever he likes.

The reason is – I am training him not to make the “impulsive decision” at the check out line.

We always stay “near the store walls” – and avoid middle isle where the packaged, process foods are.

But the register areas are inevitable…

He likes sweets. And he can get them in moderation. But the tricky thing is – I do not want him to think that these candies are reward – or something special. If he thinks they are prizes, he would put too much value in them – and will make his purchase decision accordingly when he is on his own.

Yes, I do not deprive him from sweets.

By planning ahead, you can save money, and also control the sugar intakes for yourself and your children.

OR

At Costco

$16.79

150 pieces

0.11 a piece

80 calories / each

8 g Sugar

This also offers variety

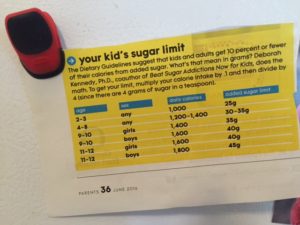

Because of the sugar lobbyists, there is no recommended sugar intake on the food labels. So we need to be aware of the sugar take ourselves.

Think for your children…

It is in our responsibilities to teach our children (and ourselves) how to think long term.

“Debt” = “Bad”

the companies that provide debt, what do you think their goal is? Is their goal for you to fully understand the cost of your debt? No. So they’re basically creating these approaches to make you feel like it is incredibly cheap or just to think about the cost per day rather the cost per year or cost for a lifetime. So debt is very simple mistake.

So there is an amazing study that shows when parents have college savings accounts for their kids, their kids show higher social and cognitive performance.

http://www.pbs.org/newshour/making-sense/mental-depletion-complicates-financial-decisions-for-the-poor/

We waste too much …

Food Facts

California Food Waste

- 100 billion pounds of food is wasted per year

- 40% of all food is thrown away or plowed over in farms

- 5 billion pounds of prepared food is wasted

- The waste is from three categories: (1) farms, (2) restaurants and cafeterias, (3) grocery stores

California Hunger

- Millions of people are hungry

- Service organizations often want access to this food, but there are many possible barriers. These organizations sometimes

- don’t know where excess food is

- don’t have credentials to show their legitimacy

- lack resources to get excess food

From WASTE NO FOOD (Download this app!)

Child Nutrition class – by Dr. Maya Adam

If you haven’t taken advantage of MOOC (Massive Online Open Course) – here’s one opportunity. Unfortunately, education became so expensive for American people, but we can always find ways for self-improvement.

I adore Dr. Maya Adam. She makes it very simple to cook everyday – while making the strong point of its social importance and for our future generation.

If you have a chance – please sign up. It’s FREE! https://www.coursera.org/learn/food-and-health